A Paradigm Shift for Tax-Optimized Retirement Income Planning

No Better Time Than Now

There is no better time than now to prepare for changing tax regimes with a comprehensive analysis of your potential income tax and estate tax liabilities.

We are keenly focused on tax minimization strategies. Wonderfully Rich Retirement® financial planning provides proactive financial planning analysis and advice and we work with tax and legal professionals to implement creative solutions.

We are in pursuit of zero tax in retirement to ensure our clients pay the lowest legal tax rate over the course of their retirement.

From Wealth Accumulation to a Protected Retirement Income Stream

It is naïve to think one can convert instantly from an accumulation-based portfolio into a tax-efficient retirement income stream that will last a lifetime.

It takes specialized planning to make this transition. Ideally, you begin years before retirement.

Our goal is to help you reach a Wonderfully Rich Retirement by building the most efficient, longest-lasting, tax-optimized retirement income stream, which does enable some clients to get to a zero-tax rate at some point in their retirement.

A Retirement Income Strategy Customized to You

Have you ever been to a seminar or met with a financial adviser and felt like you were a square peg being forced into a round hole? There is no retirement strategy that works well for everyone.

There are a number of retirement income strategies or styles that retirees and their financial professionals might employ. It is important to work with a financial professional who is agnostic, not preferring a particular device or style. We have experience with and access to all types of products and services available in the financial marketplace. Equally as important, we employ a sophisticated process to help you determine what style or strategy best suits you.

What is a Legacy Plan?

Along with retirement income planning, our legacy planning is customized to what each individual client wants in retirement.

For some, retirement is the legacy of their working years that enables years of comfortable living. For others, leaving a legacy to their heirs and/or to special charitable causes is their goal.

Together with estate planning attorneys, we create plans to minimize taxes, maximize legacy, and ensure your legacy goes where it is intended. We believe you deserve a Wonderfully Rich Retirement – on your terms.

par·a·digm shift

1. an important change that happens when the usual way of thinking about or doing something is replaced by a new and different way.

— Merriam-Webster

Wonderfully Rich Retirement® financial planning is a different approach.

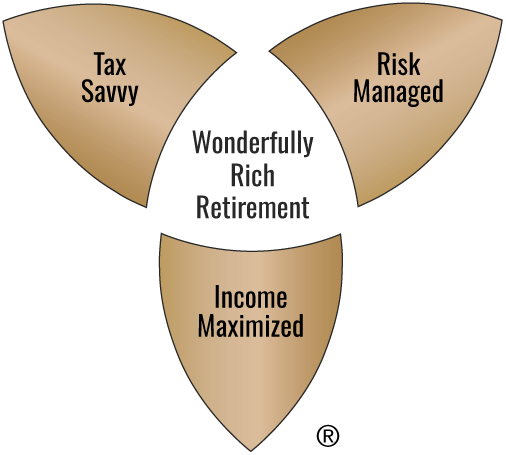

Wonderfully Rich Retirement® Financial Planning

We are on a mission to design and implement proactive, tax-optimized retirement income and estate plans that help protect our clients from taxes and volatile markets, while maximizing lifelong income and establishing a legacy.

Typical retirement planning touches only the tip of the iceberg. We go beyond to put our clients in control of the many forces that impact life in retirement:

- managing a multitude of risks,

- ensuring a reliable retirement income stream, and

- reducing tax rates toward zero.

To guide you on the path of Wonderfully Rich Retirement® financial planning, we follow a unique approach.

We differentiate our retirement income financial planning from other wealth management firms by focusing on these three critical outcomes:

Critical Outcome 1:

Tax Savvy

Many people approach retirement with little to no tax planning. During working years, they focused on minimizing taxes each year by increasing their pre-tax contributions to retirement accounts. They assumed their tax bracket in retirement would be lower. While this may be true for some, our experience is that the higher the net worth of a retiree, the lower the likelihood of a lower tax bracket. This problem is exacerbated if a large percentage of net worth is in tax-deferred accounts.

Other retirees established Roth IRAs to reduce taxes in retirement, but have not done the analysis to determine if Roth Conversions should be considered, and what other tax minimizing strategies are available.

Only rarely do we meet a pre-retiree who has an understanding of tax diversification and has worked over years to build each of the three tax buckets: the pre-tax bucket, the after-tax bucket, and the tax-free bucket. A key step in our unique planning process is a comprehensive retirement income analysis that focuses on minimizing lifelong tax. Our goal is to build the most efficient, longest-lasting, tax-optimized retirement income stream.

Some clients are able to get to a zero percent tax rate at some point in their retirement.

While our practice is keenly focused on tax minimization strategies, Charles W. Rawl & Associates, LLC does not provide tax or legal advice. We provide proactive financial planning advice and work closely with your tax and legal professionals to implement the plan.

Critical Outcome 2:

Income Maximized

Generating retirement income has rarely been as difficult as in this environment. Why?

Simple planning themes like the “four percent rule” or estimating “safe withdrawal rates” will fail to maximize lifelong income. This requires specialized planning that, like tax planning, ideally begins years before retirement.

During your working years, you updated your income plan on a regular basis, though you probably didn’t think of it that way.

You worked hard to move up the ladder and get promoted. You may have gone back to school to get another degree or designation to increase your earning potential. Or perhaps you changed companies to increase your income. But in retirement, that income external driver doesn’t exist anymore.

While being tax savvy helps us to maximize income, that alone is not enough. Our comprehensive retirement income analysis pinpoints multiple income-maximizing strategies.

Becoming Income Maximized ensures that you have legacy left. Income that lasts past your final day, to get through the finish line, not just barely to the finish line.

With a legacy left, we want to make certain it is passed on to heirs and/or to favorite causes, as efficiently as possible.

Critical Outcome 3:

Risk Managed

In the working years, people are exposed to all kinds or risk: redundancy and downsizing, businesses failing, economies collapsing, and mortgages being put under pressure or stress.

In retirement, we face an entirely new set of risks, including

- sequence of returns risk,

- inflation risk,

- longevity risk and healthcare risks,

- not to mention tax risk!

While being risk managed may seem obvious, many retirees and pre-retirees don’t fully understand all types of risks, nor the magnitude.

Most do not know how to measure the risks they are taking, nor how to comprehensively manage the risks.

With three decades of experience in financial services, encompassing commercial banking, insurance, and investment industries, and a background in financial due diligence, Charles W. Rawl has a unique perspective that delivers high value to clients.

We keep our eyes on the market from all three of these perspectives and diversify portfolios with alternative and tactical strategies, and legal and tax structures, to integrate the investment and income plan with the estate plan.

How Do We Get There?

Positioning

Current Reality

How detailed and quickly accessible are your financial, investment, and tax records?Getting Started

We work with you to create a detailed and accurate picture of your current standing as the basis for long-term success.

Retirement Success

How thoroughly have your thought out and envisioned what your ideal retirement looks like?Getting Started

Everyone’s vision for retirement is unique. We help clarify where you want to be and create the plan to get you there.

Leveraged Time

Would you say you have controlled time, or time has controlled you as you saved for retirement?Getting Started

Time is the single greatest equalizer in positioning for a Wonderfully Rich Retirement. Action is what leverages time.

Strategy

Power Zero

Have you and your tax preparer focused on minimizing annual tax or on minimizing life-long tax?Getting Started

Minimizing life-long tax allows some to get to a zero-percent tax rate at some point in retirement.

Income Mechanisms

Do you have a detailed plan to generate income for the essentials, security, and comforts in retirement?Getting Started

Considering all types and combinations of income strategies is a key to achieving a Wonderfully Rich Retirement.

Ongoing Optimization

Do you have a process to review and adjust your retirement income plan?Getting Started

Your retirement income plan must be analyzed on a regular basis to measure past success and optimize it for the future.

Portfolio

Market Reality

Do you study the current investment market and its implications on generating income as well as growth?Getting Started

You need a clear view of market reality to minimize risk and embrace opportunities so that realistic goals to be set.

Product Due Diligence

How thoroughly and objectively have you analyzed the myriad of investment and insurance products available?Getting Started

We must ensure that the underlying integrity of any product and portfolio is driven by your needs and best interests.

Multi-Dimensional Diversification

How far have you gone to diversify your investments by strategy and structure?Getting Started

Beyond a typical stocks-and-bonds portfolio, a risk-managed portfolio is diversified with alternative and tactical strategies, and legal and tax structures.

Let’s start a conversation.

Call 713.800.0334 or

Send your contact request here: