Charles W. Rawl & Associates Offers This Guide to the New RMD Rules

What Took Effect in 2024 and What’s New in 2025 and Beyond?

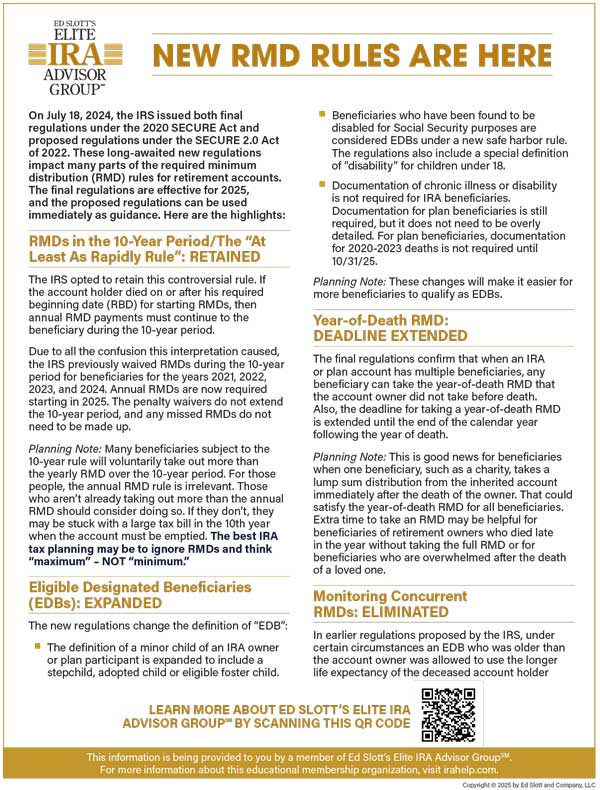

The SECURE Act and its successor SECURE 2.0 introduced significant changes to the Required Minimum Distribution (RMD) rules for retirement accounts. These changes were intended to modernize how required minimum IRA distributions are handled, and as expected, they have led to plenty of confusion.

The July 18, 2024 IRS publication clarifies several key points, including the treatment of trust beneficiaries, aggregation of RMDs, and the timing for non-spouse beneficiaries who are subject to the SECURE Act’s 10-year payout rule.

While the regulations introduce some relief, particularly for spouse beneficiaries, one significant provision remains unchanged: beneficiaries must begin taking annual RMDs if the account holder passed after their Required Beginning Date (RBD).

This shift brings new complexities, especially when calculating how much must be withdrawn each year.

Navigating New RMD Rules

For our clients and friends, We offer this guide to help you navigate these latest changes: New RMD Rules Are Here

For a deeper dive, here is a link to the IRS July 18, 2024 guidance: Treasury, IRS Issue Updated Guidance

For personalized assistance in planning your strategy for RMDs, or if you have any questions, contact our office at 713.800.0334 or send us a message using the form below:

Let’s start a conversation.

Reply here to schedule a free introductory visit with Charlie Rawl.

Learn more about putting Wonderfully Rich Retirement® financial planning to work for you!

How can we contact you?