Retirement Income & Legacy Planning in Houston, Texas

Only the Tip of the Iceberg

Typical retirement planning touches only the tip of the iceberg. We go beyond.

Charles W. Rawl & Associates reaches below the surface to put our clients in control of the forces that impact life in retirement: managing risks, ensuring a reliable retirement income stream, and reducing tax rates toward zero.

We are on a mission to design and implement proactive, tax-optimized retirement income and estate plans that help protect our clients from taxes and volatile markets, while maximizing lifelong income and establishing a legacy.

A Paradigm Shift for Retirement Income Planning

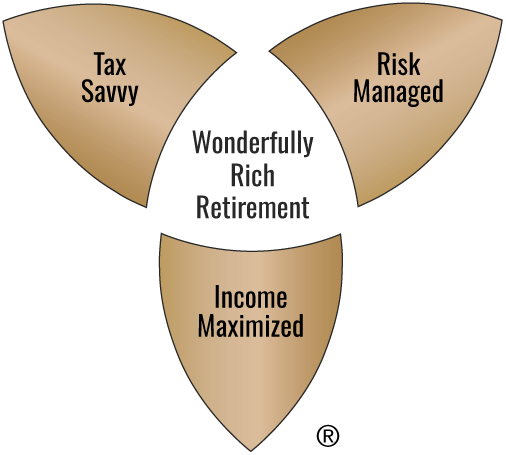

Wonderfully Rich Retirement® Financial Planning

Our goal is to help you achieve what you deserve: Financial planning for a Wonderfully Rich Retirement® defined on your terms.

To get there, we follow a unique path.

We differentiate our retirement income financial planning from other wealth management firms by focusing on these three critical outcomes:

Tax Savvy

Comprehensive Tax Savvy retirement income plan to minimize lifelong tax. Our goal is to build the most efficient, longest lasting, tax-optimized retirement income stream that could include income from three tax buckets: the pre-tax bucket, the after-tax bucket, and the tax-free bucket.

Some clients are able to get to a zero percent tax rate at some point in their retirement.

Income Maximized

Going beyond simplistic ideas like the “four percent rule” or other “safe withdrawal rates” to develop a comprehensive retirement Income Maximized plan to pinpoint multiple income maximizing strategies.

Becoming income maximized ensures that you have legacy left. Income that lasts past your final day, to get through the finish line, not just to it.

Risk Managed

Comprehensive Risk Managed retirement income and legacy plan, integrating the investment and income plan with the estate plan, to encompass new risks.

In retirement, we face an entirely different set of risks, including sequence of returns risk, inflation risk, longevity risk and healthcare risks, not to mention tax risk.

par·a·digm shift

1. an important change that happens when the usual way of thinking about or doing something is replaced by a new and different way.

— Merriam-Webster

No Better Time Than Now

There is no better time than now to prepare for the changing tax regimes ahead with a comprehensive analysis of your potential income tax and estate tax liabilities.

We are keenly focused on tax-minimizing strategies.

We provide proactive financial planning analysis and advice and work with tax and legal professionals to implement creative solutions.

From Wealth Accumulation to a Protected Retirement Income Stream

It is very difficult to convert immediately from an accumulation-based portfolio to a tax-efficient retirement income stream that will last a lifetime. This requires specialized planning that ideally begins years before retirement.

Our goal is to help you reach a Wonderfully Rich Retirement® by building the most efficient, longest-lasting, tax-optimized retirement income stream, which does enable some clients to get to a zero-tax rate at some point in their retirement.

A Retirement Income Strategy Customized to Your Unique Preferences

Have you ever been to a seminar or met with a financial adviser and felt like you were a square peg being forced into a round hole? There is no retirement strategy that works well for everyone.

There are a number of retirement income strategies or styles that retirees and their financial professionals might employ.

That is why it is important to work with a financial professional that is agnostic, not preferring a particular device or style. We have experience with and access to all types of products and services available in the financial marketplace. Equally as important, we employ a sophisticated process to help determine what style or strategy best suits them.

What is a Legacy Plan?

Along with retirement income planning, our legacy planning is customized to the unique needs and desires of each individual client.

For some, retirement is the legacy of their working years that enables years of comfortable living. For others, leaving a legacy to their heirs and/or to special charitable causes is their goal.

Together with estate planning attorneys, we craft a plan to minimize taxes, maximize legacy and ensure your legacy goes where it is intended. At Charles W. Rawl & Associates, we believe you deserve a Wonderfully Rich Retirement® on your terms.